Key takeaways

- Your down payment is not included in your closing costs; they’re two separate expenses you pay during the homebuying process.

- The down payment goes toward your home’s purchase price and helps build equity from the very beginning.

- Closing costs cover all the fees and services needed to finalize the sale, such as the appraisal, title insurance, and lender fees.

- You’ll typically pay both the down payment and closing costs at the same time, but they serve different purposes.

- Reviewing your closing disclosure carefully before signing helps you understand exactly where your money is going.

If you’re buying a home, you’ve probably asked yourself this question. The short answer: No, your down payment isn’t included in your closing costs. They’re two separate expenses that come up at the same time in the homebuying process, which is why so many buyers confuse them.

Think of it this way: your down payment is the money you contribute toward the home’s purchase price; it’s your personal investment in the property. Your closing costs, on the other hand, cover the fees and services needed to finalize the sale, such as the appraisal, title insurance, and lender fees.

Both are major upfront costs, but they serve different purposes. Understanding the difference helps you budget more confidently.

Closing costs vs. down payment

So what’s the difference between closing costs and a down payment? Let’s break it down clearly.

Down payment

What it is: The down payment is the portion of the home’s purchase price that you pay out of pocket; it’s your personal investment in the property and typically a percentage of the total cost.

Purpose: A down payment reduces the amount you need to borrow from your lender. Putting more money down can help you qualify for a smaller loan, potentially lower your interest rate, and even help you avoid private mortgage insurance (PMI) if you put down at least 20 percent.

Where it goes: The money goes directly toward the home’s purchase price, helping you start building equity from day one.

Closing costs

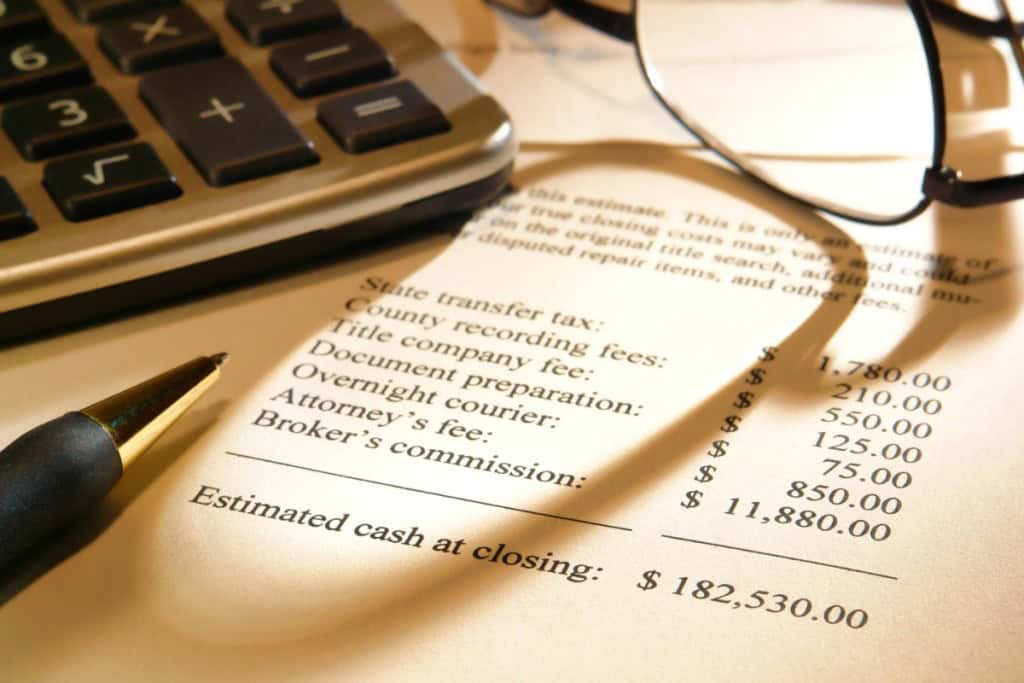

What they are: Closing costs include the fees and expenses required to finalize a home sale; they’re essentially the cost of completing the transaction.

Purpose: These fees cover the professional services and administrative work needed to process your loan and legally transfer ownership of the property.

What’s included: The list can be lengthy, but common closing costs include:

- Lender fees for processing the loan

- Appraisal fees

- Title insurance and title search fees

- Attorney fees

- Recording fees and taxes

- Initial escrow payments for property taxes and homeowners’ insurance

Where it goes: The money is distributed among all the different parties involved in the transaction, such as the lender, title company, and local government.

While both your down payment and closing costs are paid around the same time at the closing table, it’s important to budget for them separately. Your lender will give you a closing disclosure at least three days before closing, which provides a detailed breakdown of these costs.

Understanding the closing process

Let’s walk through what happens as you move toward closing and what to expect at each step.

What happens before closing day?

Before your closing date, you and the seller will agree on a specific day to finalize the sale. Your lender will then provide a document called a closing disclosure; this outlines the final details of your mortgage, including your loan terms, interest rate, and all related fees and costs.

Take the time to review this document carefully. If anything looks unclear, ask your lender or real estate agent to explain it. Understanding these details ensures there are no surprises when you sit down to sign.

What happens on closing day?

On closing day, you, the seller, and your real estate agents typically meet at a title company or an attorney’s office to complete the paperwork. If meeting in person isn’t an option, you can usually sign with a mobile notary who comes to you.

Your agent can confirm if this option is available and help you schedule enough time to review everything before signing. Once all the documents are signed and the funds are transferred, you’ll receive the keys to your new home; congratulations, you’re officially a homeowner.

Bottom line about down payments and closing costs

To sum it up, your down payment and closing costs are two separate expenses that you pay at roughly the same time, but they serve very different purposes. The down payment is your personal investment in the home; closing costs cover the fees and services needed to make the transaction official.

Understanding how both work helps you plan and avoid last-minute surprises at the closing table. When you know what to expect, you can budget more confidently and focus on finding the right home for your needs.

If you’re ready to start your home search, connect with a Redfin real estate agent who can guide you through the buying process and help you find a property that fits your budget and lifestyle.

Frequently asked questions

- Do closing costs include the down payment?

No. Your down payment and closing costs are two separate expenses. The down payment goes toward your home’s purchase price, while closing costs cover the fees for processing the loan and transferring ownership. - How much are closing costs on a home purchase?

Closing costs typically range from 2% to 5% of the home’s purchase price. The exact amount depends on factors such as your loan type, lender fees, and local taxes. - Can closing costs be included in the mortgage?

In some cases, yes. You may be able to roll certain closing costs into your loan, but doing so increases your loan balance and interest over time. It’s best to talk with your lender about your options before closing. - How much should I save for a down payment?

A common goal is to save 20% of the purchase price to avoid private mortgage insurance (PMI). However, many loan programs allow down payments as low as 3%, depending on your credit score and eligibility. - Who pays closing costs — the buyer or the seller?

In most transactions, the buyer pays the majority of closing costs, but the seller may agree to cover part of them through a concession or negotiation. Your Redfin agent can help you understand what’s typical in your area.

The post Is Down Payment Included in Closing Costs? appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.

Join The Discussion