If you’ve seen headlines about home prices dropping, it’s easy to wonder what that means for the value of your home too. Here’s what you really need to...

2025

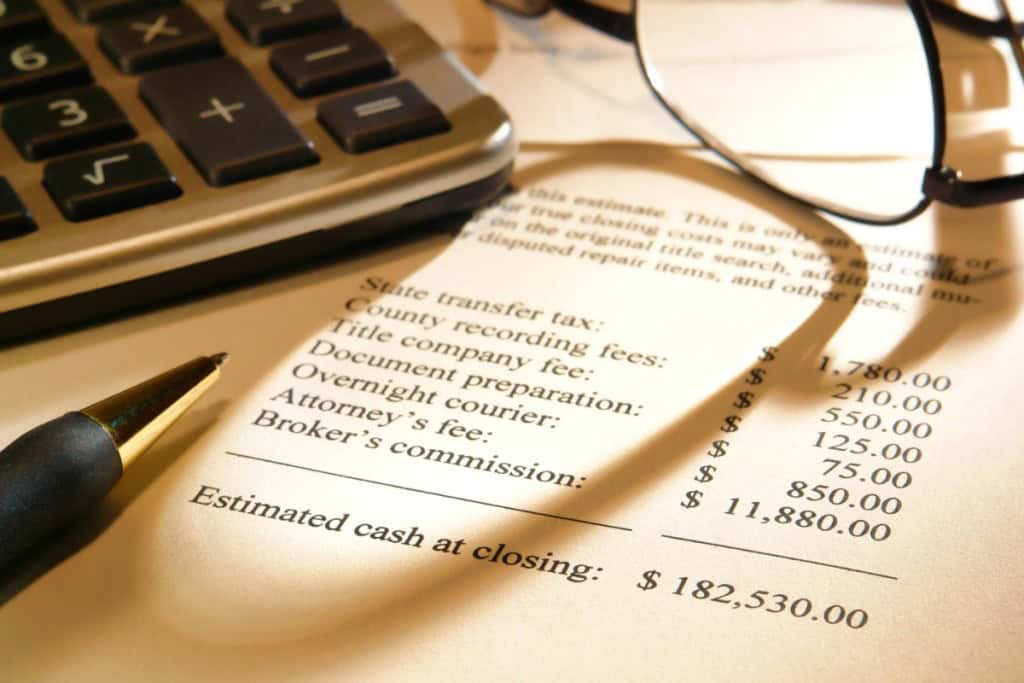

Key takeaways Your down payment is not included in your closing costs; they’re two separate expenses you pay during the homebuying process. The down payment goes toward your home’s purchase price and helps build equity from the very beginning. Closing costs cover all the fees and services needed to finalize the sale, such as the appraisal, title insurance, and lender fees. You’ll typically pay...

Heat waves continue to affect most of the U.S. this summer. Here's how you can protect your HVAC system during the heat and conserve energy...

Buying a home is rarely just about the purchase price. Behind the scenes, dozens of smaller numbers (think loan fees, taxes, insurance, and escrow deposits) add up to one of the most important figures in the transaction: your cash to close. It’s the lump sum you’ll need to bring to the closing table to finalize your home purchase. Many buyers assume it’s the same as the down payment, but it’s...

If you've ever wondered which method of refreshing your walls saves you more time in the long run, the experts are here to...

Heat waves continue to affect most of the U.S. this summer. Here's how you can protect your HVAC system during the heat and conserve energy...

If you’re planning to flip a house – buy a property, renovate it, and sell it for a profit – understanding your financing options is essential. In this Redfin article, we’ll break down the most common types of loans for flipping houses, how to qualify, and what to watch out for when borrowing. Whether you’re renovating a home in Detroit, MI, or transforming a fixer-upper in San Antonio, TX, this...

Buying a home with a VA loan can be one of the most affordable paths to homeownership for eligible service members, veterans, and surviving spouses. But what if you’re eyeing a foreclosed property? Can you use your VA benefits for that? In this Redfin article, we’ll break down everything you need to know about using a VA loan to buy a foreclosure, including how it works, what to watch for, and key...

If you’ve built up equity in your home, you might be wondering how to tap into it without selling. A cash-out refinance lets you do just that by replacing your existing mortgage with a new, larger one and taking the difference in cash. In this Redfin article, we’ll explain what a cash-out refinance is, how it works, its pros and cons, and when it might make sense for you. Whether you’re renovating...

There’s nothing quite like the thrill of getting the keys to your new home and imagining how you’ll furnish it. The perfect sofa, a dining table for hosting, maybe new bedroom furniture to match the space. But that excitement can fade fast when you realize your dream sofa is on back order for 12 to 18 weeks. Between shipping delays, limited inventory, and long lead times, it’s hard to feel...